Indigo Platinum Mastercard Review at www.indigocard.com at mythdhr.com is an informative article for, indigo platinum mastercard credit limit, destiny mastercard reviews, indigo credit card complaints.

Read also: MyTHDHR Your Schedule Login at mythdhr.com

Indigo Platinum Mastercard is a good option for those people who have bad credit or no credit history at all.

This credit card can help students and people who need a credit card after declaring bankruptcy since it does not need a credit check for prequalification.

Through this card, you can build or rebuild low credit as long as you make regular payments.

However, make sure to note that you may be charged an annual fee based on your creditworthiness. Also, this credit card has a high APR of 24.90%, and it carries a credit limit of $300. Nevertheless, it is one of the best credit cards that will help you to build your credit history.

Rates and Fees of Indigo Platinum Mastercard Review

Interest Rates and Charges | Fees

Regular APR (%): 24.9% variable

Annual Fee $75: the first year, $99 there after

Rewards Earning Rate: This card does not offer a rewards program.

Foreign transaction fee (%): 1%

Pros and Cons of Indigo Platinum Mastercard

Pros Explained

- A $0 annual fee option exists for those who qualify

- Make your card look pretty with free extra card designs

- No deposit necessary

- 1% foreign transaction fee is lower than other cards in this category.

Recommended: Burger King Survey Free Whopper

Cons Explain

- High annual fees for most card options

- Low $300 credit limit

- No rewards

- No low intro APR

- High fees, including a high APR.

The Indigo Platinum Mastercard is designed for applicants with poor credit (which Experian, one of the three credit bureaus, defines as having a credit score of between 300 and 579) who want to build or rebuild their credit history (the card’s transactions are shared with those agencies).

Indigo Card Contact Info

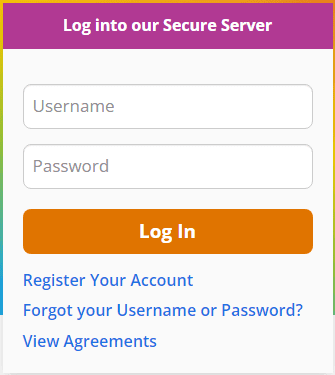

If you have any queries or are still has confusion about the Indigo Platinum Mastercard, then you can contact the customer service department. The following details you can use to contact the Indigo Card Customer Service:

Phone: 866-946-9545

Fax: 503-268-4711

Mail:

Genesis FS Card Services

PO Box 4477

Beaverton, OR 97076-4477

Is Indigo credit card legit?

The Indigo Credit Card is a pretty good unsecured credit card for people with bad credit, offering a $300+ credit limit with no security deposit needed. The Indigo Card has an annual fee of $0 – $99, which is worth paying if you have damaged credit and need a credit card for emergency borrowing.

What credit score do you need for Indigo Platinum Mastercard?

The Indigo Platinum Mastercard is designed for applicants with poor credit (which Experian, one of the three credit bureaus, defines as having a credit score of between 300 and 579) who want to build or rebuild their credit history (the card’s transactions are shared with those agencies).

Is Indigo platinum a real credit card?

The Indigo Platinum Mastercard is an option “for those with less than perfect credit,” as the card’s website states — but it may not be an ideal one. The card, issued by Utah-based Celtic Bank, comes in a variety of different colors and designs, but don’t let that distract you from its potentially high fees.

What is the highest limit for Indigo credit card?

The maximum credit limit for the Indigo Mastercard is $300. This credit limit is not the most competitive and is not subject to an increase, like some other credit cards for limited or bad credit.

How much is the Indigo credit card limit?

The Indigo Card’s credit limit is $300. In other words, you could have as little as $201 to spend initially, depending on the annual fee.

Reference Link